Interest rates play a crucial role in the dynamics of the property market in the UK. They influence borrowing costs, affordability, demand, and overall market sentiment. If you are planning to value my property, understanding the impact of interest rates can help buyers, sellers, and investors make informed decisions. This guide explores how interest rates affect various aspects of the UK property market.

1. Influence on Mortgage Rates

Borrowing Costs

Interest rates set by the Bank of England directly affect mortgage rates. When interest rates rise, mortgage rates typically increase, making borrowing more expensive.

- Higher Monthly Payments: Increased interest rates lead to higher monthly mortgage payments for new borrowers and those on variable-rate mortgages.

- Affordability: Higher borrowing costs reduce the affordability of mortgages, potentially lowering the demand for property.

Fixed vs. Variable Rates

- Fixed-Rate Mortgages: Borrowers with fixed-rate mortgages are insulated from short-term interest rate fluctuations, providing stability in their repayments.

- Variable-Rate Mortgages: Those with variable-rate or tracker mortgages will see their monthly payments fluctuate with changes in interest rates, directly impacting their monthly budgets.

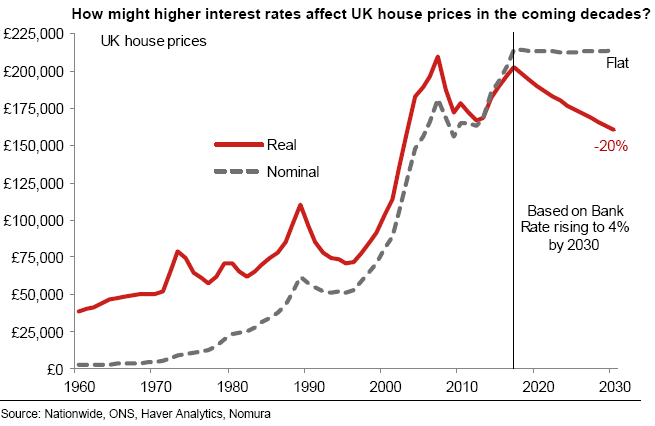

2. Impact on Property Prices

Demand and Supply Dynamics

Interest rates influence the demand and supply dynamics in the property market.

- Higher Interest Rates: Increased borrowing costs can reduce the demand for property as fewer people can afford to buy, leading to a potential slowdown in property price growth or even a decline in prices.

- Lower Interest Rates: Lower borrowing costs make mortgages more affordable, increasing demand for property and potentially driving up prices.

Investor Activity

- Buy-to-Let Market: Higher interest rates can reduce profitability for buy-to-let investors due to increased mortgage costs, potentially leading to reduced investment activity.

- Property Investment: Investors may seek alternative investments with better returns if property investment becomes less attractive due to high borrowing costs.

3. Affordability and Buyer Behavior

First-Time Buyers

First-time buyers are particularly sensitive to changes in interest rates.

- Affordability Challenges: Higher interest rates can make it harder for first-time buyers to afford their first home, reducing their ability to enter the property market.

- Mortgage Approvals: Stricter lending criteria and higher interest rates can result in fewer mortgage approvals for first-time buyers.

Home Movers and Remortgaging

- Home Movers: Existing homeowners looking to move may be deterred by higher interest rates, leading to reduced market activity.

- Remortgaging: Homeowners looking to remortgage may face higher rates, affecting their decision to switch lenders or terms.

4. Economic Confidence and Market Sentiment

Consumer Confidence

Interest rates are a key indicator of economic health and can significantly impact consumer confidence.

- High Interest Rates: High rates may signal efforts to control inflation, which could be associated with economic instability, reducing consumer confidence and spending, including on property.

- Low Interest Rates: Low rates often aim to stimulate economic growth, boosting consumer confidence and encouraging spending and investment in property.

Market Sentiment

- Buyer Sentiment: Changes in interest rates can affect buyers’ perceptions of the market, influencing their willingness to buy or invest.

- Seller Sentiment: Sellers may adjust their price expectations based on changes in demand influenced by interest rate fluctuations.

5. Short-term vs. Long-term Effects

Short-Term Effects

Immediate Response: Immediate responses in the property market can occur to changes in the interest rates, and the potential buyers or sellers of property immediately realign their plans accordingly.

Market Volatility: There is volatility in property prices and transaction volumes because of short-term rate changes.

Long-Term Effects

Sustained trends: High or low interest rates over prolonged periods can set up long-term trends in the property market; this influences overall market stability and growth.

Investment Decisions: The trends in interest rates over the longer term are that prices affect investment decisions, such as in property development and buy-to-let investments.

6. Regional Variations

London and Southeast

Higher value of properties: Areas of higher property prices, such as London and the South East, become more sensitive to interest rate changes as the mortgage amounts borrowed are higher.

Investor Hotspots: These are areas that involve high investment, and thus an alteration of an interest rate can have remarkable effects on the activity levels of the investors.

Regional Markets

Affordability: This may be less dramatic in regional markets with more affordable property prices, although changes in interest rates would still impact on demand and affordability.

Local Economies: The impact of rates of interest relies on the economies of local regions and rates of employment.

7. Policy Implication

Central Bank Policy

Monetary Policy: The Bank of England uses interest rates as its instrument of controlling inflation and stabilizing the economy; the real estate and housing market are directly greatly included.

Policy announcements: The announcements based on regard for the future of the interest rate policy can influence expectation and behaviour in the market.

Government Initiatives

Housing policies: Whatever the government initiatives put in place, be it Help for Buy or stamp duty holidays, they can either reduce or amplify the effects of interest rate changes to the property market.

Affordable Housing: Policies aiming to expand affordable housing inventories may change the way interest rate changes affect various market segments.

Conclusion

Interest rates are the central determinants that control the whole UK property market by influencing mortgage rates, property value and prices, affordability, and buyer behavior, just to name a few things. These dynamics, in essence, tend to be very important in the realms of buyers, sellers, investors, and policymakers. It is, hence, important to have this in mind when going further to make more comprehensive decisions in the property markets.

Read Also: Unlocking Creativity: The Ultimate Guide to Animated Banner Makers